AI Investing Tools That Are Beating Human Traders in 2026

Introduction to AI-Driven Investing

The stock market in 2026 doesn’t sleep, blink, or panic and that’s because artificial intelligence is now running a massive part of it. While human traders are still sipping coffee and scanning charts, AI investing tools are already making thousands of decisions per second. Sounds unreal? It’s not.

Why 2026 Is a Turning Point for Financial Markets

This year marks a shift where AI tools are no longer “assisting” traders they’re outperforming them. With smarter models, real-time data ingestion, and self-learning algorithms, AI has crossed a critical line.

Humans vs Machines: A New Reality

Human intuition once ruled Wall Street. Now, intuition has competition. AI doesn’t guess it calculates. And in 2026, calculation wins more often than gut feeling.

What Are AI Investing Tools?

AI investing tools are software platforms that use artificial intelligence to analyze markets, predict price movements, manage portfolios, and execute trades automatically.

Evolution from Algorithmic Trading to AI

Old-school algorithms followed fixed rules. Modern AI adapts. Think of it like the difference between a calculator and a brain that learns from every mistake.

How AI Investing Tools Work

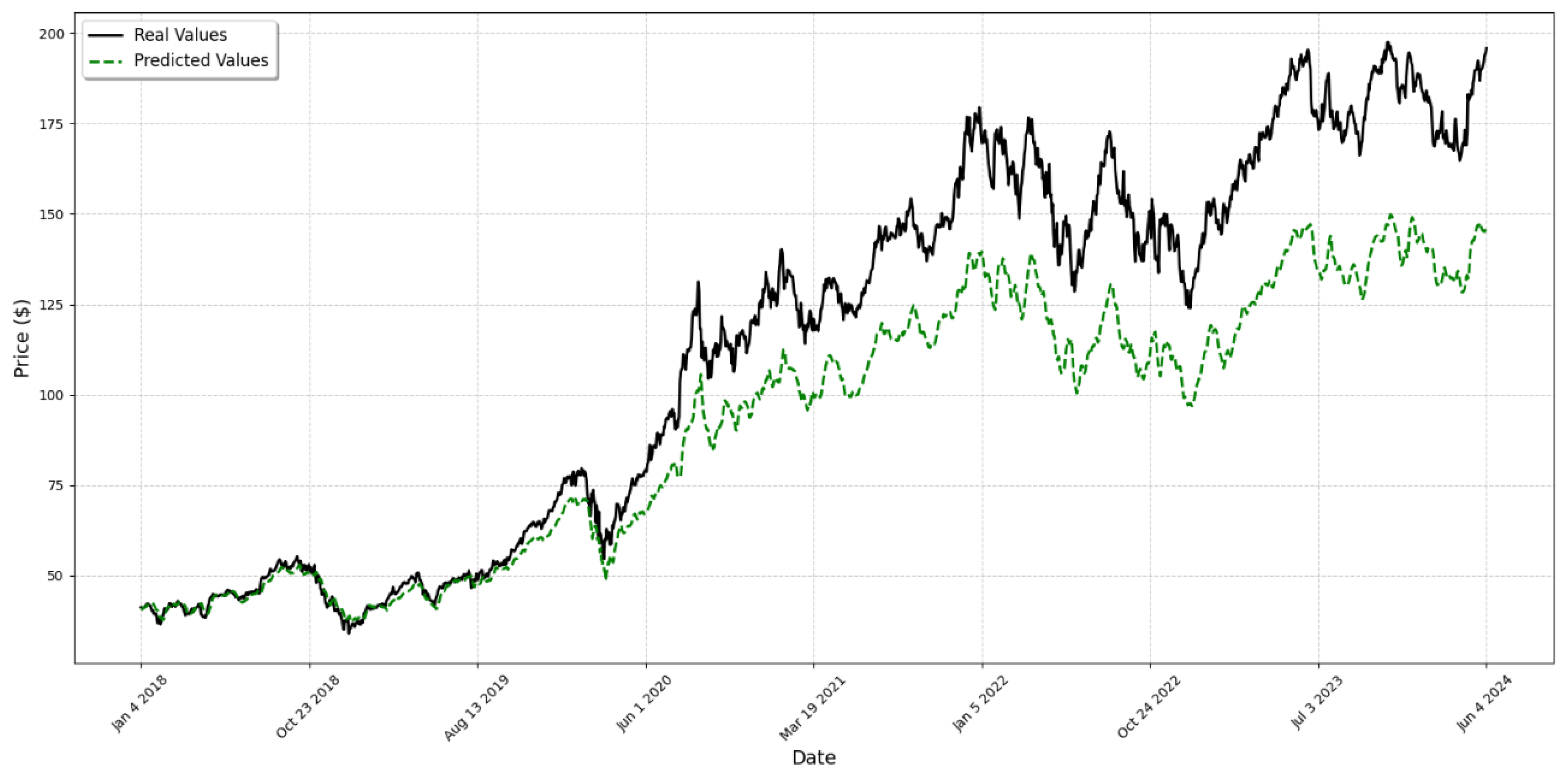

Machine Learning and Predictive Models

AI models digest decades of market data and spot patterns invisible to humans.

Supervised vs Unsupervised Learning

Supervised models learn from labeled data, while unsupervised ones uncover hidden structures. Together, they create frighteningly accurate predictions.

Natural Language Processing (NLP) in Finance

AI reads earnings calls, news articles, and even tweets faster than any analyst team.

Reinforcement Learning in Trading

Like training a chess engine, AI traders learn by trial, error, and reward—constantly improving strategies.

Why AI Is Beating Human Traders

Speed Beyond Human Capability

Humans react in seconds. AI reacts in microseconds. In trading, that gap is everything.

Emotion-Free Decision Making

Fear and greed ruin portfolios. AI doesn’t feel either.

24/7 Market Monitoring

While humans sleep, AI watches Asian, European, and crypto markets nonstop.

Top AI Investing Tools Dominating 2026

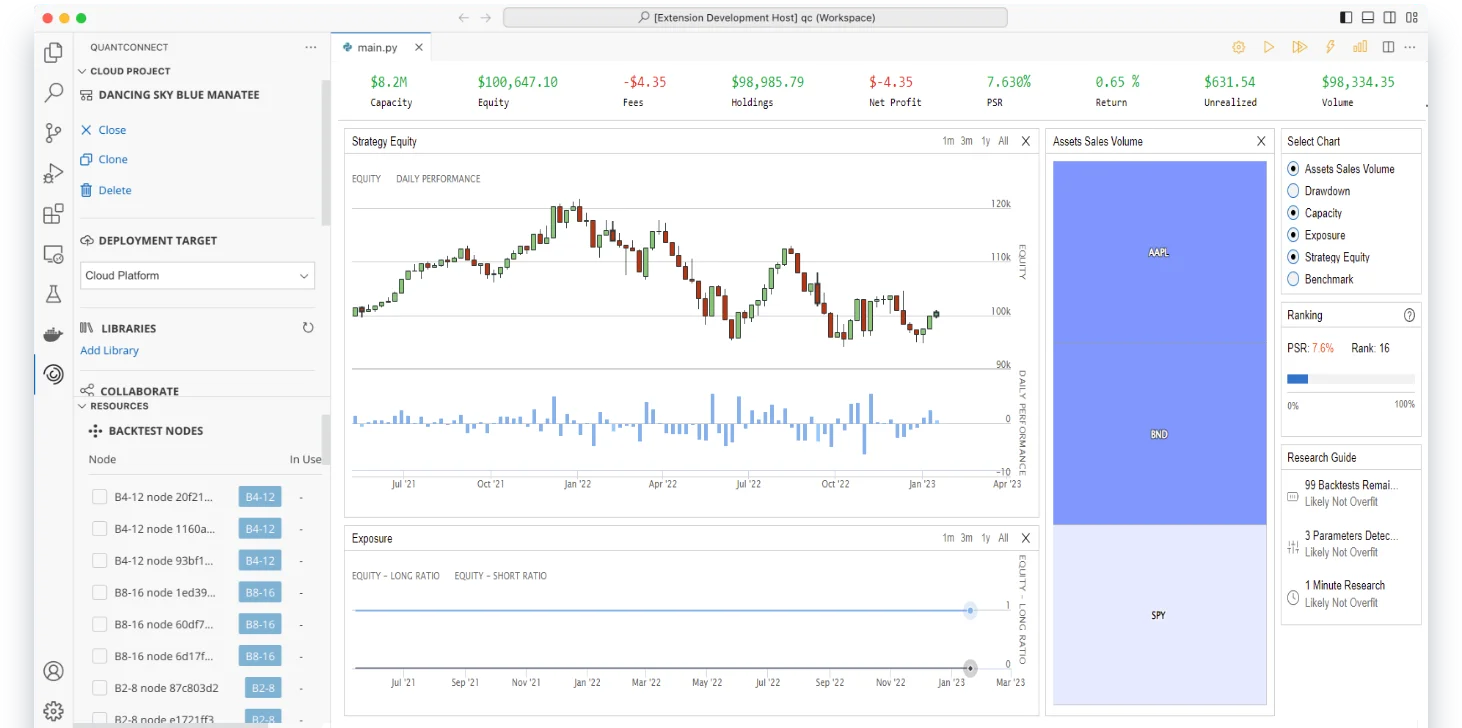

QuantConnect AI

An institutional-grade platform using crowd-sourced AI strategies with brutal backtesting.

Kavout Kai

Famous for its AI-driven “K-Score,” ranking stocks based on probability of outperformance.

Trade Ideas AI

Retail traders love it. Institutions respect it. Its AI, “Holly,” executes trades with surgical precision.

AlphaSense

Uses NLP to analyze millions of documents for investment insights.

BlackRock Aladdin

Not flashy, but terrifyingly powerful. It manages trillions using AI risk analytics.

AI Hedge Funds vs Human Fund Managers

Performance Metrics in 2025–2026

AI-driven hedge funds are consistently beating benchmarks like the S&P 500.

Risk Management Comparison

AI predicts drawdowns earlier and reallocates faster than humans ever could.

AI in Stock Market Trading

High-Frequency Trading (HFT)

AI dominates HFT, exploiting tiny price gaps thousands of times per day.

AI-Powered Stock Screening

Forget spreadsheets. AI screens entire markets in seconds.

AI Tools for Retail Investors

Robo-Advisors 2.0

Modern robo-advisors now adapt portfolios in real time, not quarterly.

AI Portfolio Optimization Apps

Apps in 2026 act more like financial co-pilots than tools.

Role of Big Data in AI Investing

Alternative Data Sources

Satellite images, shipping data, web traffic, AI eats it all.

Real-Time Data Processing

Latency is death. AI thrives on instant data.

AI and Cryptocurrency Trading

Volatility Prediction

AI predicts crypto swings with higher accuracy than traditional indicators.

Sentiment Analysis from Social Media

Reddit, X, Telegram—AI reads the crowd before the crowd moves.

Benefits of Using AI Investing Tools

Higher Accuracy

Data-driven beats intuition-driven.

Reduced Risk

AI diversifies and hedges automatically.

Scalability

One AI can manage millions of portfolios.

Risks and Limitations of AI Trading

Overfitting Models

Too much historical focus can blind AI to new realities.

Black Box Decisions

Sometimes even developers don’t know why AI made a trade.

Market Crashes and AI Behavior

When everyone uses AI, herd behavior can amplify crashes.

Regulations and Ethical Concerns

Global Financial Regulations in 2026

Governments now demand transparency in AI decision-making.

Transparency and Accountability

Who’s responsible when an AI loses billions? Still a gray area.

Future of Human Traders

Hybrid Human-AI Models

The smartest firms combine human creativity with AI execution.

New Skills Traders Must Learn

Data science beats old-school chart reading.

How to Choose the Right AI Investing Tool

Factors to Consider

Accuracy, transparency, cost, and adaptability.

Cost vs Performance

The cheapest tool can be the most expensive mistake.

Final Thoughts on AI Investing in 2026

AI investing tools aren’t the future they’re the present. In 2026, the question isn’t whether AI beats human traders, but how long humans can stay relevant without it. The smartest move? Don’t fight the machine—learn to work with it.

0 Comments

Feedback will be Appreciated